From devoted owners of dogs and cats to those who cherish the company of smaller animal companions, the pet industry has been steadily booming worldwide, transforming from a $320 billion industry into a powerhouse projected to reach a staggering $500 billion by 2030.

Yet what might be the driving force behind this remarkable growth and shift in attitudes towards pet ownership in recent years?

It's more than just adorable faces and wagging tails; it's a thriving sector with immense potential, and this is particularly pronounced in the culturally diverse and economically vibrant region of Asia. Asia is not only a global player in the pet industry, but it's also a dynamic hub that exemplifies the growing importance of pets and their well-being. To shed light on this potential, Intage Group has provided insights into the pet industry's substantial growth through a comprehensive survey conducted in four captivating countries: India, Thailand, Indonesia, and China, the insights have painted a vivid picture of the distinct pet ownership trends in each of these culturally rich nations.

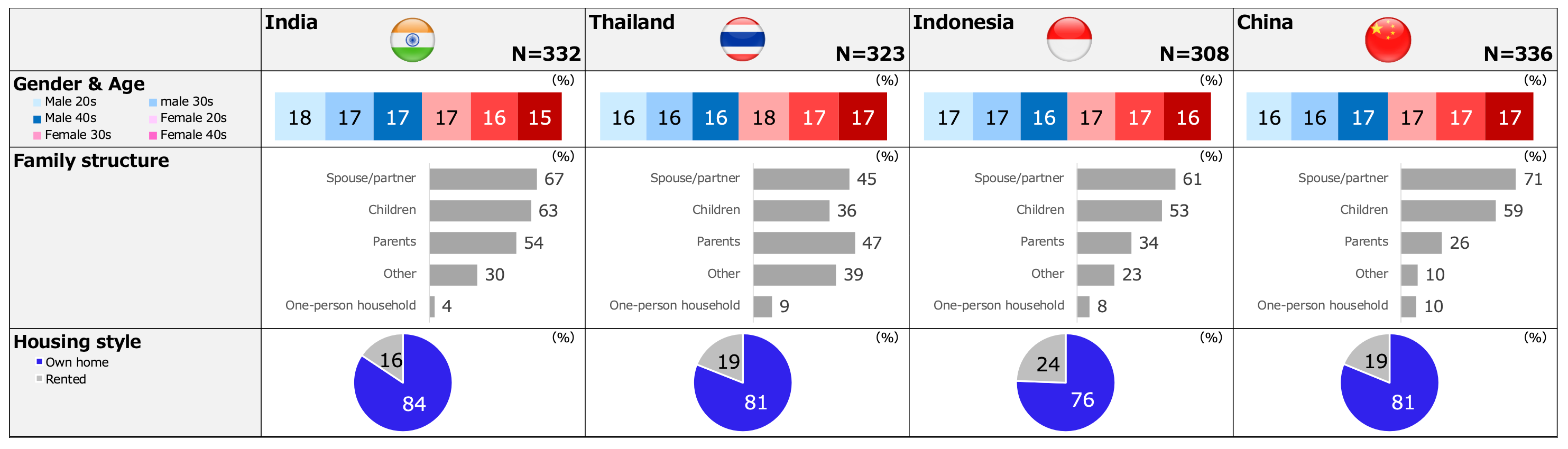

The survey infographic is taken from the "U&A Survey on Dog and Cat Owners - The Expanding Asian Pet Market 2023," featuring respondents aged 20s-40s across four Asian markets. The sample sizes are as follows: India (N=332), Thailand (N=323), Indonesia (N=308), and China (N=336). The data was collected through an online questionnaire survey conducted by the Intage Group from March 14 to 29, 2023, in collaboration with and presented by dataSpring.

Segmentation

This image is courtesy of Intage Group

This image is courtesy of Intage Group

Just How Many Pets Are We Talking about?

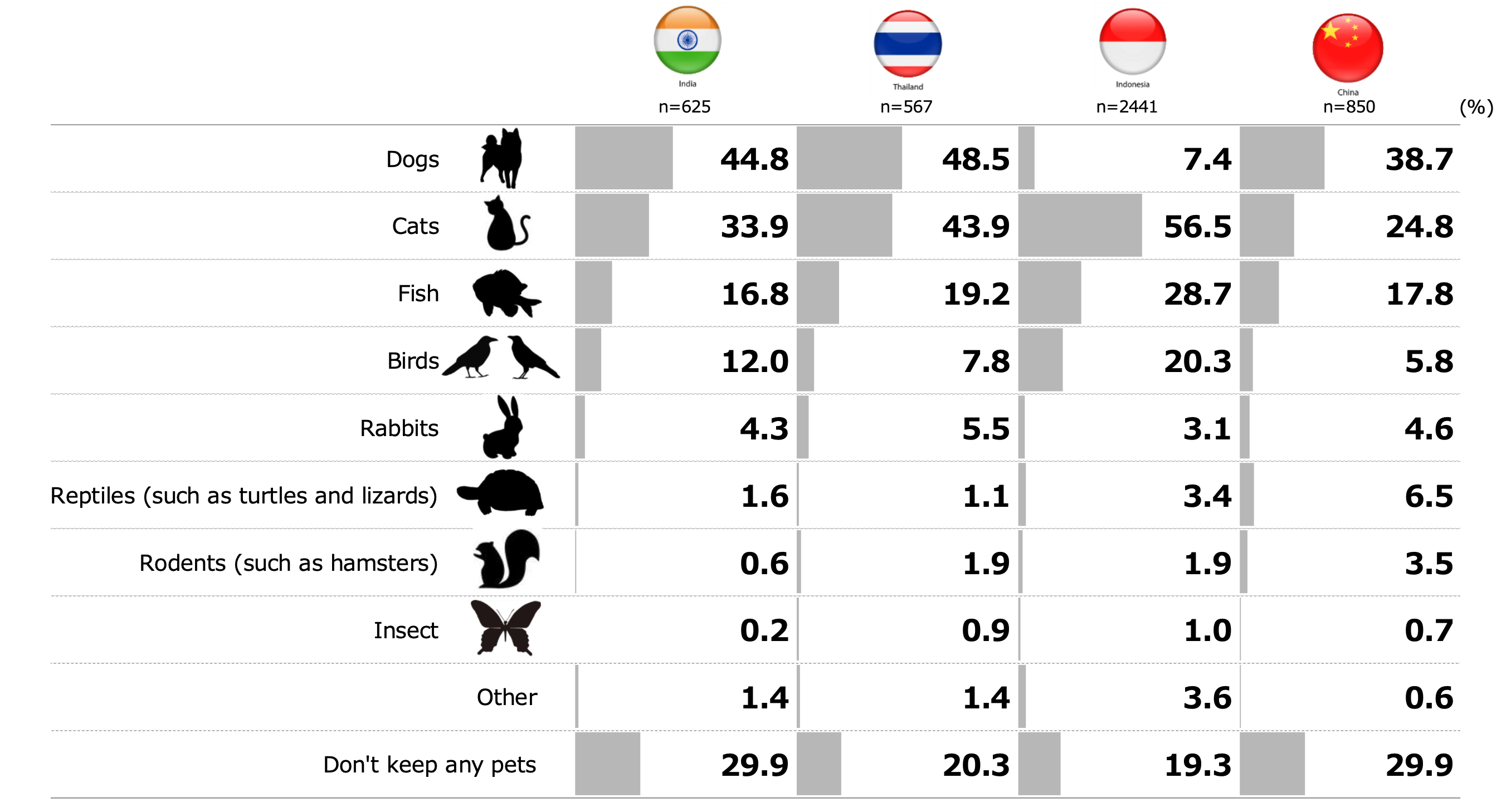

Ownership Rate of Pets by Type

This image is courtesy of Intage Group

Results showed that the majority of the households (70-80%) have at least one type of pet in their homes The ownership rate of pets by type indicates that "dogs" prevail in households in India (44.8%), Thailand (48.5%), and China (38.7%) while for Indonesia "cats" (56.5%) are preferred due to its Muslim-majority population.

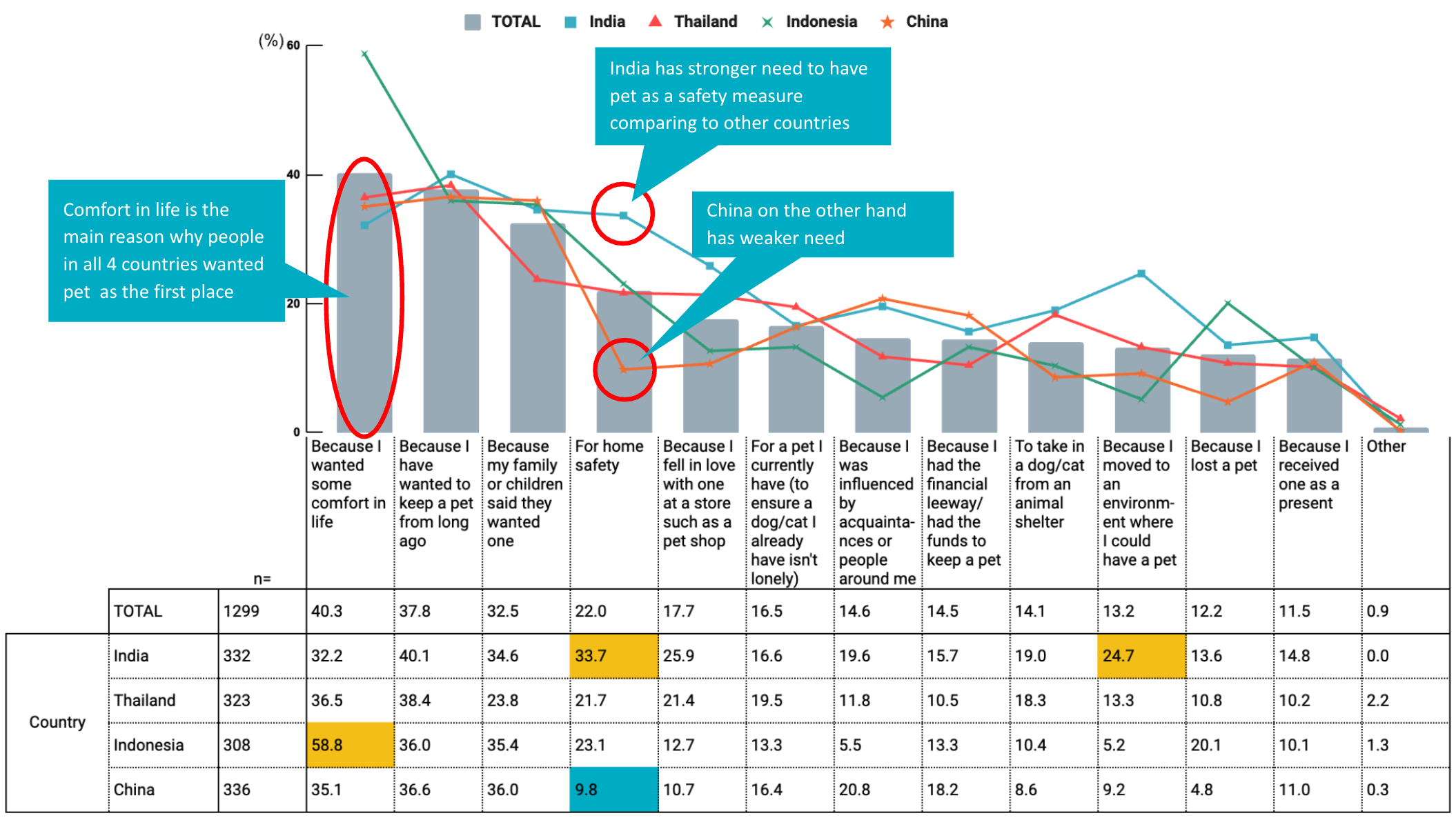

What trigger people to start keeping pet

This image is courtesy of Intage Group

This image is courtesy of Intage Group

As pets seamlessly integrate into households, several factors drive people to welcome these companions into their lives. The predominant reason that triggered adoption across the 4 surveyed markets is "because they wanted some comfort in life" (40.3%). This inclination may be attributed to the lifestyle shift prompted by the pandemic, wherein enforced confinement and health threats could have strained people's mental and emotional well-being. Consequently, many turned to the companionship of pets, evident in the remarkable rise in pet populations across each country in recent years. The surge paved the way for the growing trend of humanizing pets and treating them as family members, fueling the expansion of the pet care products and services sector with owners developing a penchant for pampering their pets.

In Thailand, the pet population has increased by a compound annual growth rate (CAGR) of 2.3% from 2016-2021, rising from 16.5 million to 18.5 million over the historic period. This sparked 127,000 people to attend the 2022 Pet Expo where more than 300 booths featuring hawkers selling pet food, toys, and services connecting animals in shelters with new owners.

Similarly, Indonesia's market is experiencing significant growth in recent years and even expected to reach US$ 2,298.4 Million in 2023 and likely to surpass 5,883.2 Million by 2033 at a CAGR of 9.5% from 2023 to 2033. Giving several opportunities for companies in Indonesia to answer the growing demand, the market is still poised to contribute a demand share of nearly 1.5% in the global pet care market.

On the other hand, What triggered some Indian respondents to keep a pet stems from a different perspective, "For home safety" (33.7%). Presumably, this pertains to pet "dogs", as the ownership rate of dogs is the highest in the country and they could serve as guard dogs for families. In contrast for Chinese respondents, it is less likely for them to need a pet for safety measures.

Issues Faced by Pet Owners

The one thing that most trouble the pet owner

This image is courtesy of Intage Group

This image is courtesy of Intage Group

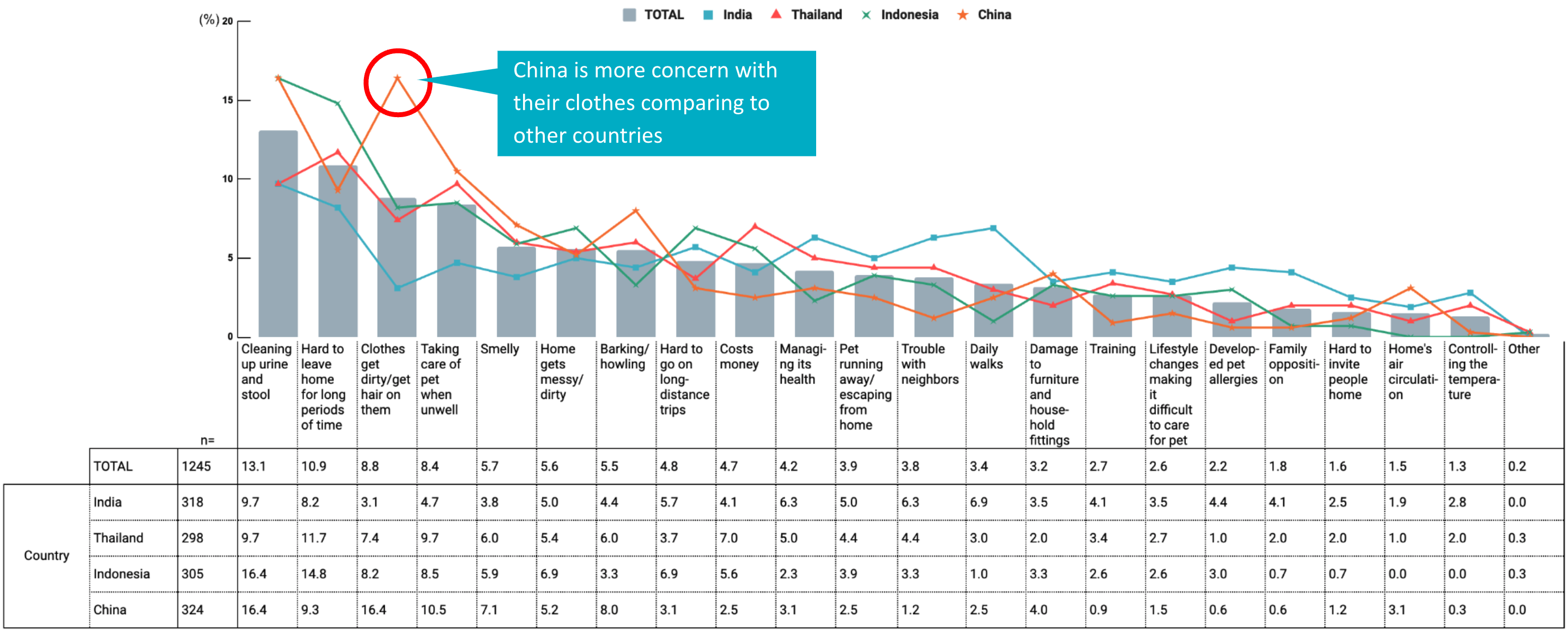

While owning a pet can undoubtedly bring comfort to people's lives, pet owners still encounter specific challenges. The survey identifies four primary issues faced by owners across the four countries:

- Cleaning up urine and stool (33.9%): This emerges as the top concern across markets, indicating the shared difficulty of maintaining cleanliness when owning a pet.

- Clothes get dirty/get hair on them (26.9%): Interestingly, this concern tops the list for Chinese respondents, emphasizing the importance of pet hygiene and its impact on personal items.

- Hard to leave home for a long period (25%): The difficulty of long trips away from home due to pet care responsibilities ranks third, indicating a significant lifestyle consideration for pet owners.

- Smelly (24.6%): Ranking fourth is the issue on unpleasant odors from pets that also highlights how crucial to address cleanliness when owning a pet.

Notably, for Chinese respondents, both "Cleaning up urine and stool", and "Clothes get dirty/get hair on them" are significant issues, each at 16.4%.

While all of the top issues for pet owners primarily revolve around dealing with pet care, odor and hygiene, the pet industry has responded to this with innovative solutions. Products and services such as pet-friendly fabrics to minimize hair build-up, diapers, pads in different sizes, and even pet hotels for owners to board their pets while they go on vacation have emerged.

Proving that the growth of the pet industry in recent years prompted businesses to provide an innovative and pet-centric approach to fulfilling the basic needs of pets. Simultaneously highlighting a key opportunity in the pet health area. As owners now demand more than just basic pet food; the survey reveals that each country has its own criteria when selecting pet food, emphasizing a growing awareness and emphasis on the health nutrition of pets.

What Pet Owners Consider Important for Pet Food

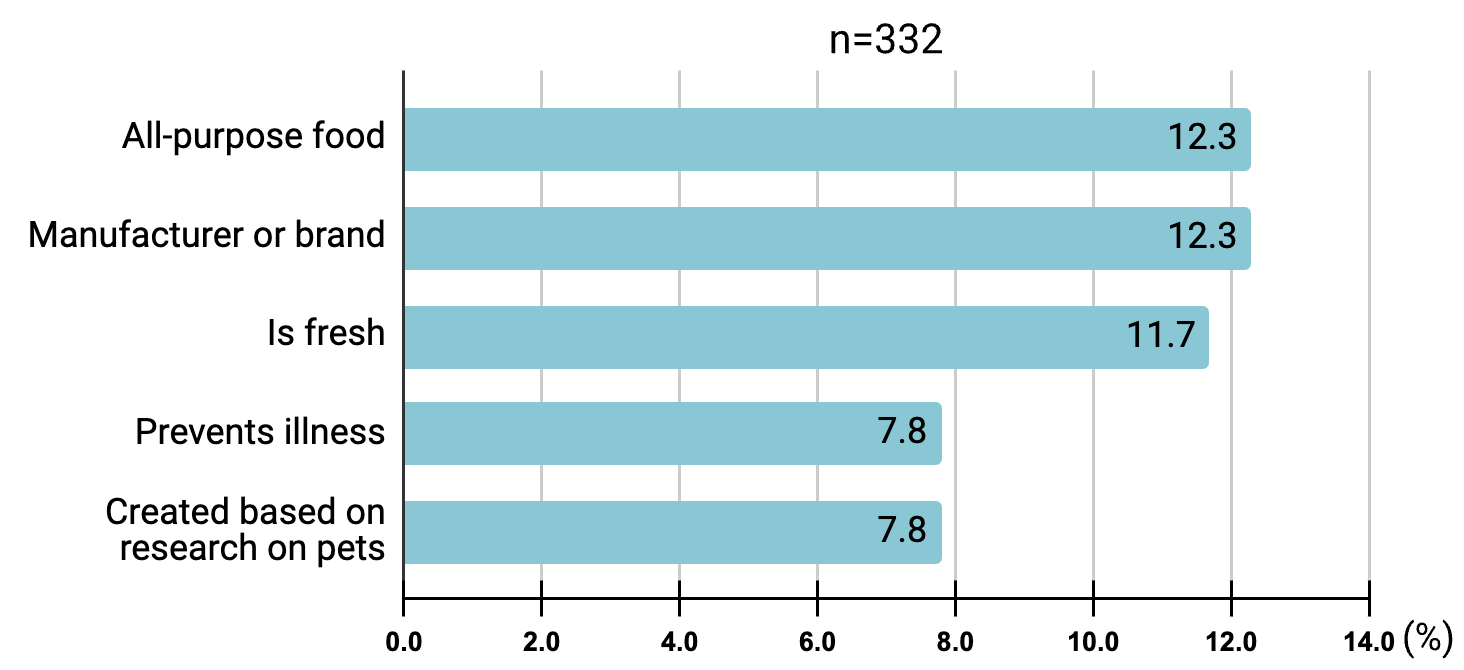

The most important criteria for pet food (India)

This image is courtesy of Intage Group

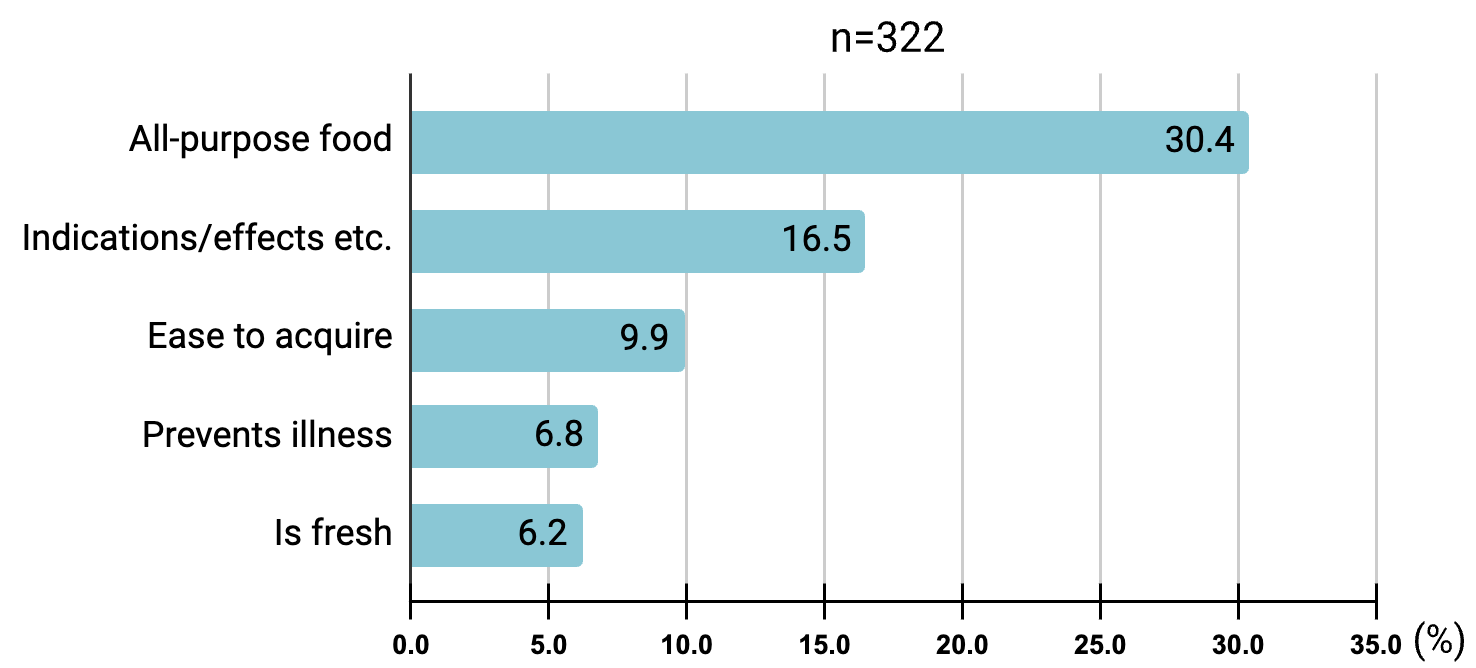

The most important criteria for pet food (Thailand)

This image is courtesy of Intage Group

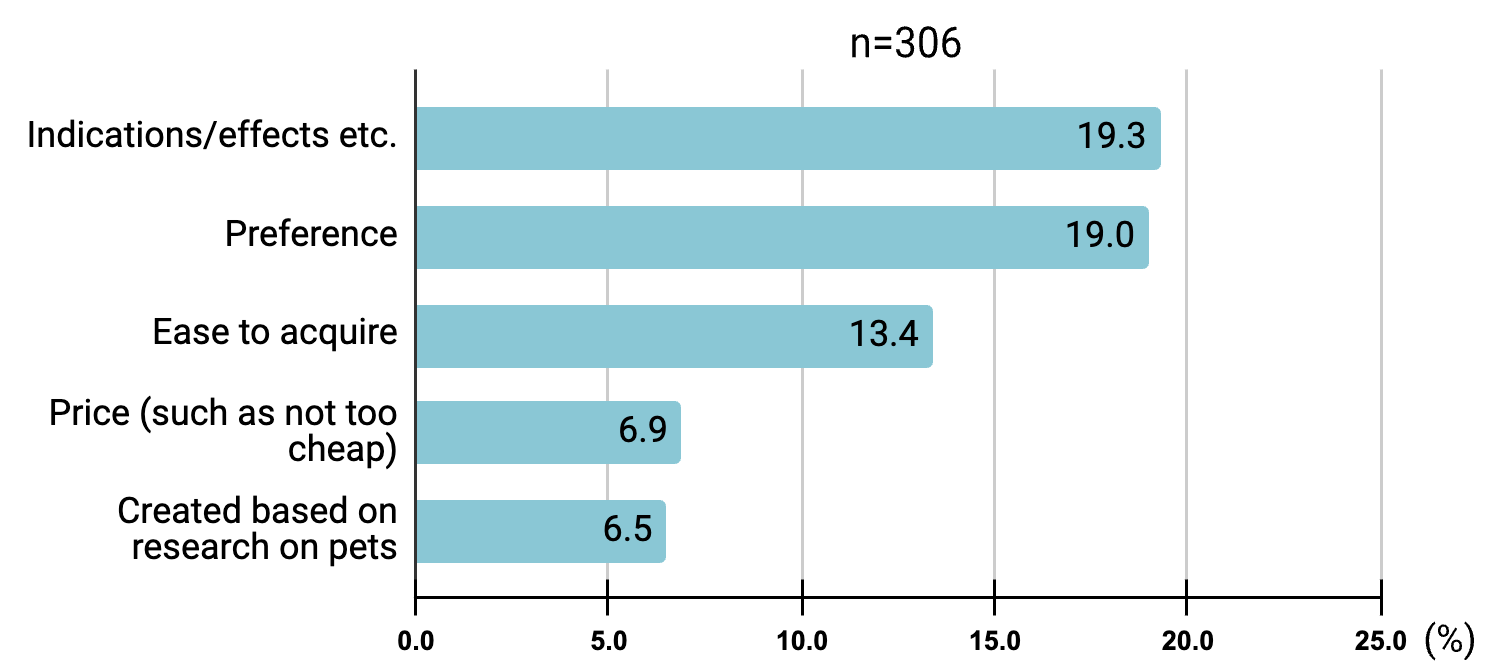

The most important criteria for pet food (Indonesia)

This image is courtesy of Intage Group

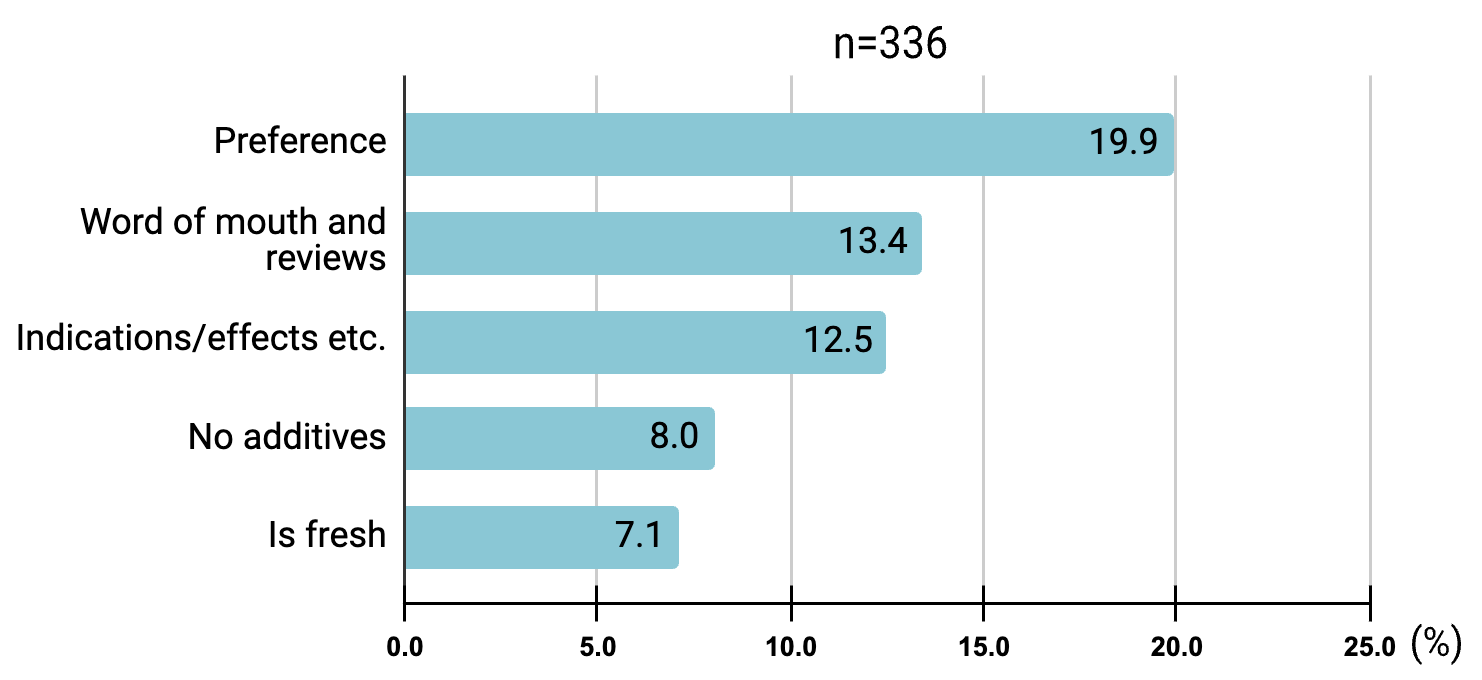

The most important criteria for pet food (China)

This image is courtesy of Intage Group

For India, the primary criteria for their pet's food are both "All Purpose Food" and "Brands," each accounting for 12.3%. In Thailand, a significant emphasis is placed on "All Purpose Food" as well,however with a more substantial rate of 30.4% among Thai respondents.

On the other hand, Indonesia pet owners would lean towards Pet food that has "Indications/effects, etc"(19.3%), Lastly, in China, respondents base their choice on their pet's taste or "preference" (19.9%) followed by "word of mouth or review on the product"(13.4%).

While pet owners' criteria for pet food may vary per market, there is still an obvious concern with nutrition. This urged companies to review their approach when developing their food as pet owners seek their pet's individual health needs and convenient options which undoubtedly will be in higher prices propelling to premiumization of pet food and encouraging them to trade up.

Other Expenditures of Pet Owners

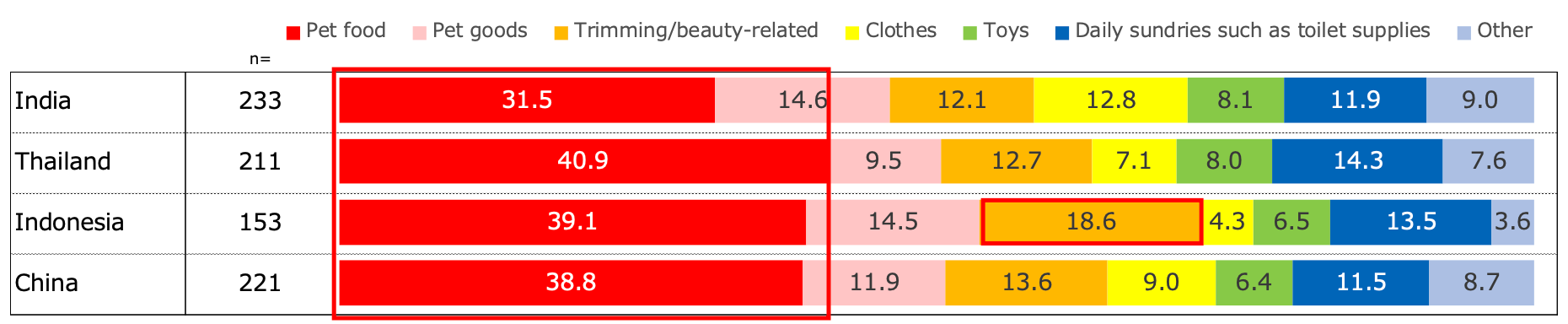

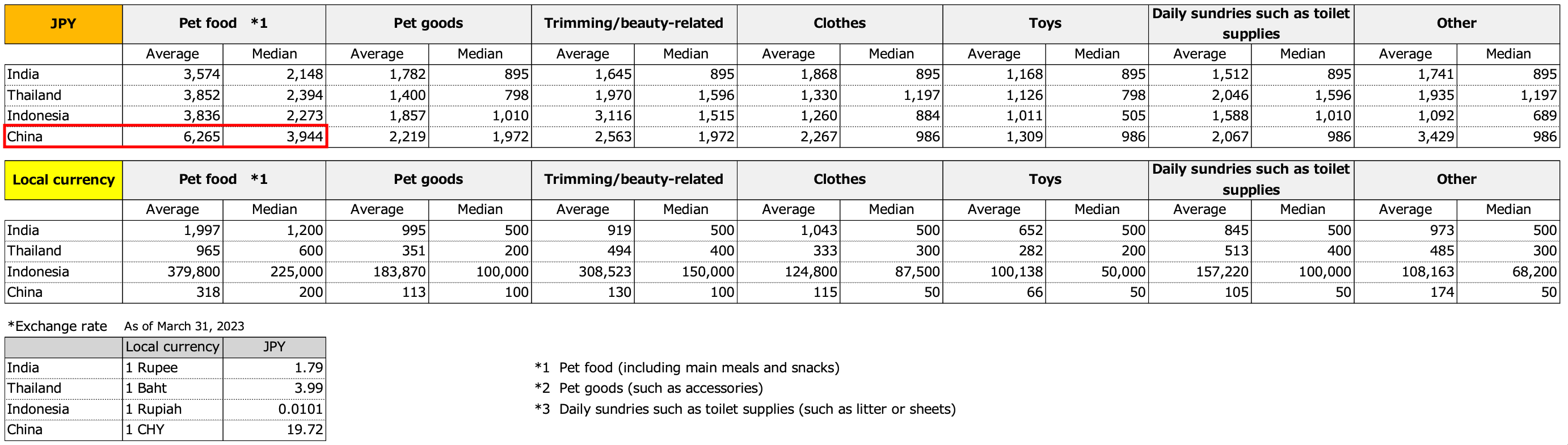

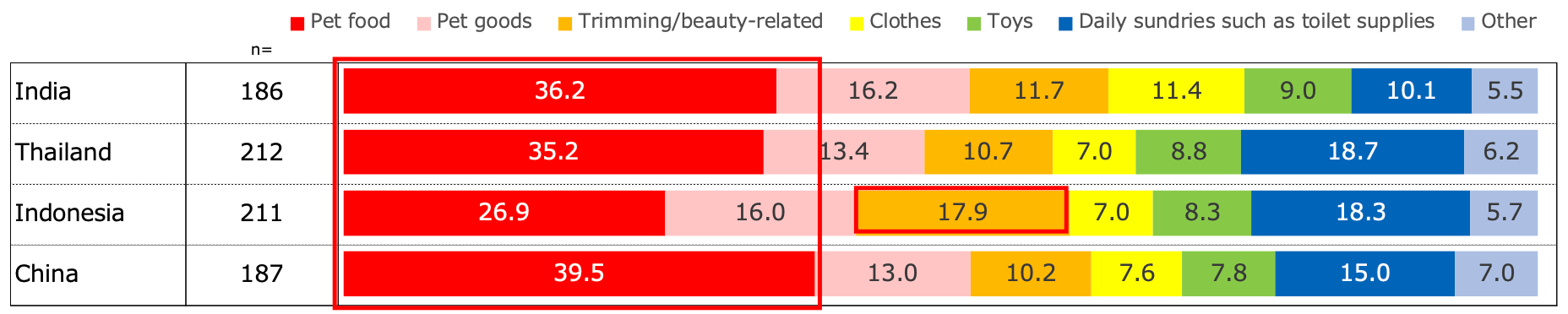

Spending on Pet's Health (Monthly Expenditure) - Dog

In addition to dog food, owners also display beauty related expenditure in Indonesia

- In all 4 countries, the greatest expenditure among the 7 attributes is on “Pet food”.

- In Indonesia, a higher proportion spend on “Trimming/beauty-related” than in other countries.

- Chinese expenditure on “Pet food” is by far the greatest among the 4 countries.

Expenditure item composition ratio

Monthly payment amount

Q13_D Approximately how much do you pay for the following per month? An approximate amount is fine, so please give the average you spend monthly.

This image is courtesy of Intage Group

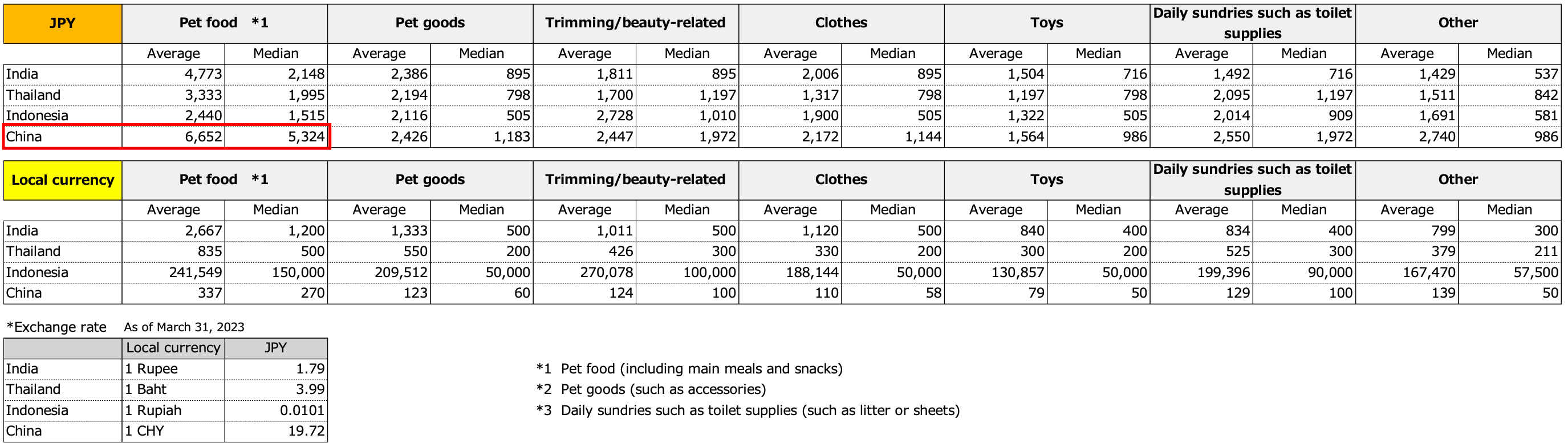

Spending on Pet's Health (Monthly Expenditure) - Cat

Akin to dogs, owners spend on cat food, and also display beauty-related expenditure in Indonesia

- In all 4 countries, the greatest expenditure among the 7 attributes is on “Pet food”.

- In Indonesia, a higher proportion spend on “Trimming/beauty-related” than in other countries.

- Chinese expenditure on “Pet food” is by far the greatest among the 4 countries.

Expenditure item composition ratio

Monthly payment amount

Q13_C Approximately how much do you pay for the following per month? An approximate amount is fine, so please give the average you spend monthly.

This image is courtesy of Intage Group

Given that it is primarily driven by dogs and cats, pet food is not the only expenditure that their owners have, which is prominently seen in Indonesia as both owners of the breed also display a higher proportion of spending on "trimming/beauty-related" expenditure. While the common highest expenditure across markets is food, Chinese owners are more than willing to spend on their pet's food compared to others, having the highest median (JPY 3,944) or an average of JPY 6,265 which is double that of the 3 other markets when it comes to the monthly payment amount for dog food, and a median of JPY 5,324 or in an average of JPY 6,652 for cat food.

Takeaways

The survey have highlighted a profound transformation in pet ownership due to the pandemic as many people have turned to adopting pets to seek comfort in their life in trying times and as people where forced in a different lifestyle. As a result of this shift, it turned pets into an integral member of households evident in the growing population and trend of "humanizing" or treating pets like a family member across the 4 markets surveyed. This shift has led to an increase expenditure on pets and a surge in the industry's premiumization, as owners seek higher-quality products and services.

This presents a great opportunity for businesses to tap into and navigating the diverse preferences and cultural nuances such as the region of Asia will be vital. Intage Group alongside its leading panel provider dataSpring, can provide a roadmap to successfully gather insights. Whether it may be understanding the penchant for "All Purpose Food" in Thailand or the safety-driven motivations in India when owning pets, Intage Group is dedicated in providing support for your research endeavors.

Contact Intage Group now to learn more about the growing pet industry in Asia or if you want to unlock valuable insights, and position your business for success in the evolving and dynamic landscape of Asia.

You can also explore the survey infographic in Japanese on Intage Group's Global Market Surfer and get valuable insights from consumers from Asia!

Download Panel Book

Download Panel Book