![[Case Study] Shampoo Buyer Personas: Taiwan](https://www.d8aspring.com/hs-fs/hubfs/Eye-on-Asia/20171207-taiwan-shampoo-case-study.jpg?width=1760&name=20171207-taiwan-shampoo-case-study.jpg)

With the popularity of dataSpring's recent general case study of shampoo buyer behavior across China, South Korea, and Indonesia, we decided to extend the study for further insights.

With a more focused approach, we will be analyzing the buyer behaviors and creating personas in the Taiwan shampoo market.

ENJOY!

- Survey Method: Online Research

- Country: Taiwan

- Targeting: 20-49yo

- Survey Period: August 22, 2017 (Tuesday) - August 28, 2017 (Monday)

- Complete N: 300 samples

FINDINGS:

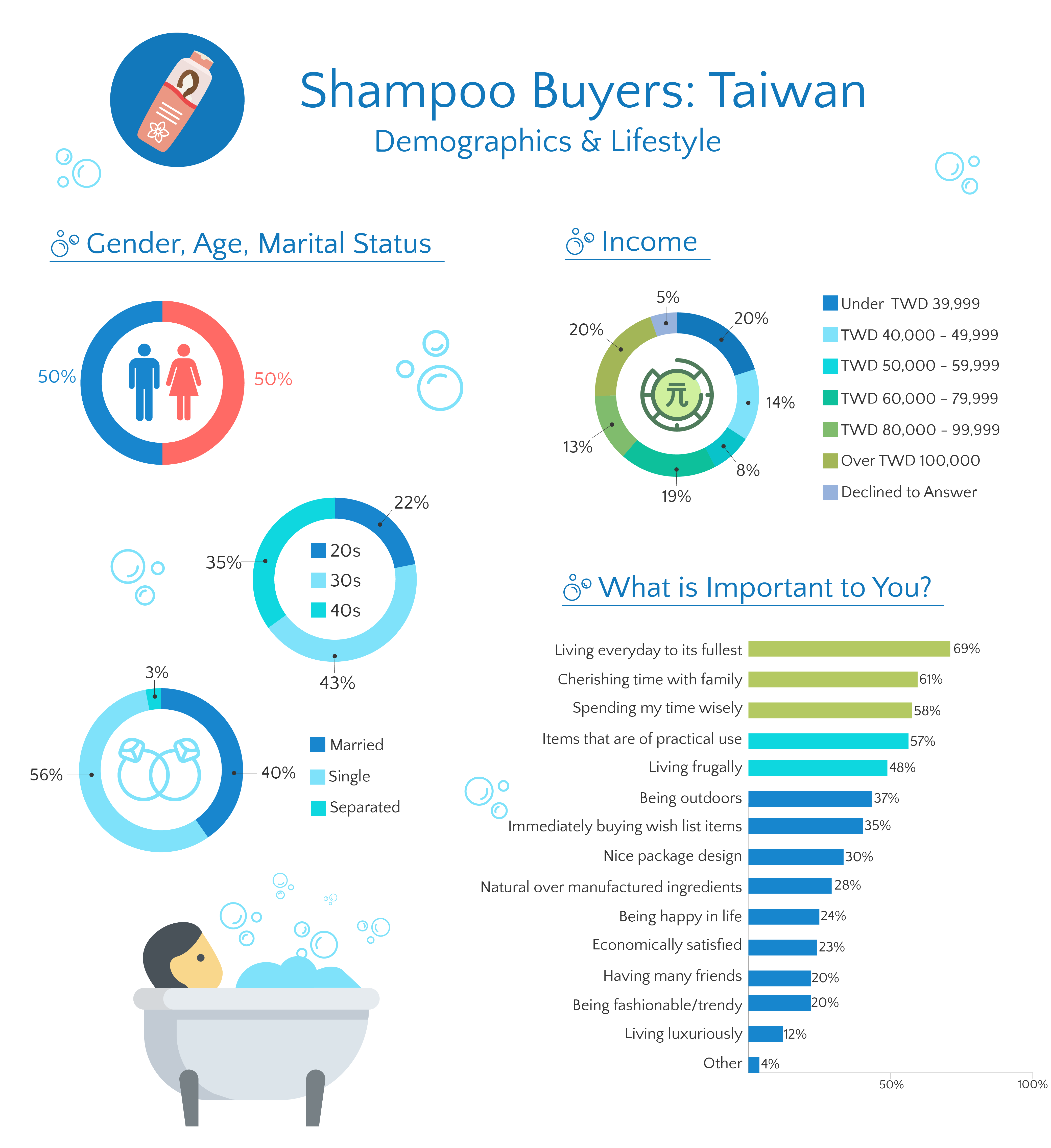

1. Who We Interviewed - The Demographics

To get a better understanding of the shampoo and beauty market in Taiwan, we decided to survey 300 males and females aged 20-49. Of the people we surveyed, 50% were male while 50% were female. We also asked them about their marital status, age, and income. And finally, to get a better understanding of general buyer behavior, we asked about their lifestyle, which factors they care about/which factors are most the relatable to their life, in which survey takers chose what they valued by picking multiple choice answers.

From asking more about their lifestyle, we can get a better understanding of the kind of mindset consumers have when deciding on purchasing or not purchasing items. From the data, we can see that "Living every day to its fullest" was 69%, while matters like family and personal time-related answers were 61% and 58% respectively. Another popular answer was obtaining "items that were of practical use" while "living frugally" made the top five list of answers as well.

With these popular answers in mind, we can see that, for Taiwanese consumers, there is a heavy focus on how consumers choose to spend their time and money.

2. Shampoo Insights - What They Buy and Why

Just as our general study revealed, foreign brands ranked high in recognition and usage in Taiwan. When asked the open-ended question of which brand they were currently using, many Taiwanese chose global brands like P&G's 飛柔 (PERT) and Unilever's 多芬 (Dove). We were surprised to find Japanese brand Kao rank second, between two global giants.

With fragrances, consumers ranked very similarly to our Indonesian consumers with floral and mint taking first and second places respectively. From the three top-ranked fragrances - floral, mint, and forest - we can see that natural and outdoor scents are a favorite among Taiwanese consumers.

As for their buyer behavior, we can see the aforementioned focus on money as the top-ranked reasons for purchase are functions and affordability.

3. Buyer Personas - Five to Use Today!

For many marketers, understanding your market is one step to a successful marketing plan. The next is creating buyer personas to put a face to the name of your target market. Use these five buyer personas to easier understand the shampoo and beauty market in Taiwan.

心怡 (Hsin-yi)

Our first buyer persona, Hsin-yi is a single female in her early 30s. Hsin-yi lives with her partner and has an annual income of around TWD 40,000~49,999. For Hsin-yi, she cares about the design and look of what she buys (nice package design), living frugally and having more natural products. When purchasing shampoo she cares most about the scent, reliability, and whether or not it is organic. Her favorite scent is floral and forest and she currently uses the shampoo brand Amida.

To get a better understanding of her lifestyle and purchasing behavioral decisions, we've asked Hsin-yi to provide us with a picture of her bathroom. Hsin-yi generally likes her bathroom space. It is clean and it allows her to refresh. She often complains that the hot water fluctuates and is hard to control.

靜宜 (Ching-yi)

Our second buyer persona Ching-yi, is a single female in her early 20s. Ching-yi lives alone and has an annual income of over TWD 60,000~79,999. For Ching-yi, she cares about living frugally as well as having many friends. When purchasing shampoo she cares about the scent and whether the shampoo is branded for younger consumers. Her favorite scent is mint, forest, and citrus and she currently uses the shampoo brand Le Pichet.

To get a better understanding of her lifestyle and purchasing behavioral decisions, we've asked Ching-yi to provide us with a picture of her bathroom. She says that her apartment is old so it is hard to clean the dirt off despite many attempts to brush and clean.

宗翰 (Tsung-han)

Our third buyer persona Tsung-han, is a single male in his late 20s. Tsung-han lives by himself and has an annual income of under TWD 39,999. For Tsung-han, he cares about buying his wish list items immediately, being outdoors, living with style, and being trendy, as well as living his days to the fullest. When purchasing shampoo he cares a lot about the functions, price and quantity of the shampoo. His favorite scent is floral and he currently uses the shampoo brand 澎澎 (PONPON).

To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Tsung-han to provide us with a picture of his bathroom. For Tsung-han, he does not like that the windows make the room a bit cold.

承翰 (Cheng-han)

Our fourth buyer persona Cheng-han, is a single male in his late 30s. Cheng-han lives with his parents and has an annual income of around TWD 40,000~49,999. For Cheng-han, he cares about spending time with his family, as well as caring about his personal time, living life to the fullest and living frugally. When purchasing shampoo he cares most about buying his favorite brand, good reviews, reliability, and organic products. He likes more mint, citrus, and forest scents and currently uses the shampoo brand 施巴 (Sebamed).

To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Cheng-han to provide us with a picture of his bathroom above. For Cheng-han and his family, he often complains about the ventilation of the bathroom since it often causes mold.

彥廷 (Yan-ting)

Our final buyer persona Yan-ting, is a married male in his early 30s. Yan-ting lives with his parents, partner, and child and has an annual income of over TWD 100,000. For Yan-ting, he cares about spending time with his family, natural products and the design/packaging of a product. When purchasing shampoo he cares most about if everyone in his family can use it and if it is organic. His favorite scent is citrus and he currently uses the shampoo brand 楽健 (Pregain).

To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Yan-ting to provide us with a picture of his bathroom. For Yan-ting and his family, he often complains about the limited space.

4. A Deeper Dive Into Taiwanese Shampoo

When reviewing the pictures from our panelists, we found that there were many brands that are only found in Taiwan. Among all panelists surveyed, here are four of the brands that came up a lot.

-

施巴 Sebamed (ROHTO - Pharmaceutical Company - Japanese)

Rank: 13th (total results)

Sebamed is manufactured under Japanese Pharmaceutical Company Rohto. In Japan, the brand is known for making skin care goods that are geared towards sensitive skin and dry skin. However in Taiwan, due to media and heavy advertising, the brand has a general image as a hypoallergenic shampoo brand.

-

A'MIDA (A'mida 專業沙龍髮品)

Rank:13th (total results)

A'MIDA 專業沙龍髮品 is a Taiwanese hair care brand that focuses on dyed, damaged, and general hair care. The company does not have a website but instead uses Facebook as their main online presence. Because of this, we could only get information on their products rather than the company. From looking at their Facebook page, we can see that the company focuses on influencer marketing and is popular with the 20s~40s demographic. As they do not sell through their own website nor through offline efforts, it seems the company mainly has an online presence on Facebook, Yahoo, and Rakuten.

-

澎澎 PONPON (Nice Enterprises - Taiwanese)

Rank: 11th (total results)

澎澎 PONPON from Taiwanese company Nice Enterprises is an environmentally friendly hair care brand. The company focuses on products like clothing, detergent, hair care goods, and facial wash for men and women. The brand itself is very famous and well known throughout Taiwan. Aside from their 澎澎 PONPON brand, Nice Enterprises also has other brands “SARA SARA" and “566” that are also well known. In fact, “566” was ranked at fifth place for shampoo brands. The company mainly uses TV commercials to promote their products.

The company, Nice Enterprises, is considered a major company within Taiwan. Established in 1964, the company also does business in manufactured foods, as well as runs theme parks and department stores.

-

髮職人 Le Pichet (Jia Qi Enterprises Ltd. - Taiwanese)

Compared to the previous brands, 髮職人 Le Pichet is fairly new. Known for its very good scent, the product has become famous among young women. Without the use of a product website or social media account like Facebook, the brand does most of its selling online. However due to the lack of channels the brand uses to sell and it's popularity, it is said to be difficult to obtain as it is often out of stock, even from major online shops like Watsons.

Final Comments: Taiwanese Shampoo Consumers

Brands, end-clients such as FMCGs, and retailers will need to focus on natural ingredients, as well as functions and affordability for this market in order to deliver on the growing consumer expectations and demand.

We hope this was an educational and interesting read for you! If you would like to run an online or mobile study in Asia, don’t hesitate to contact us!

Download Panel Book

Download Panel Book