![[Case Study] Shampoo Buyer Personas: Indonesia](https://www.d8aspring.com/hs-fs/hubfs/Eye-on-Asia/20171101-shampoo-buyer-personas-Indonesia.jpg?width=640&name=20171101-shampoo-buyer-personas-Indonesia.jpg)

With the popularity of dataSpring's recent general case study of shampoo buyer behavior across China, South Korea, and Indonesia, we decided to extend the study for further insights.

With a more focused approach, we will be analyzing the buyer behaviors and creating personas in the Indonesia shampoo market.

Enjoy!

- Survey Method: Online Research

- Country: Indonesia

- Targeting: 20-49 years old

- Survey Period: August 22, 2017 (Tuesday) - August 28, 2017 (Monday)

- Complete N: 300 samples

Findings:

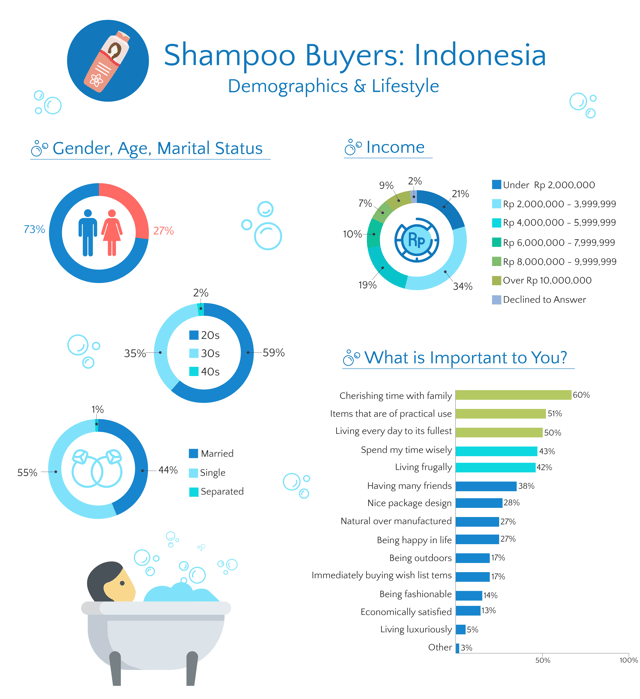

1. Who We Interviewed - The Demographics

To get a better understanding of the shampoo and beauty market in Indonesia, we decided to survey 300 males and females aged 20-49. Of the people we surveyed, 73% were male while 24% were female. We also asked them about their marital status, age, and income. And finally, to get a better understanding of general buyer behavior, we asked about their lifestyle - particularly which factors they care about and which factors are most relatable in their life - in which survey takers chose what they valued by picking multiple choice answers.

From asking more about their lifestyle, we can get a better understanding of the kind of mindset consumers have when deciding on purchasing items. From the data we can see this feedback. Additionally, spending time with family is ranked higher as a priority than having a luxurious lifestyle or 'being fashionable'.

2. Shampoo Insights - What They Buy and Why

Just as our general study revealed, foreign brands ranked high in recognition and usage in Indonesia. International brands like Unilever's Clear and P&G's Pantene ranked high as being the most used brands. In regards to the scent of their hair care products, consumers cited refreshing and sweet scents like floral or mint as their favorites.

When asked about the reasoning behind their purchase behavior, the most popular answer was 'Reliability' at 60%. While other factors like 'Quantity' and 'Brand Name' ranked less than 15%.

3. Shampoo Buyer Personas - Four to Use Today!

For many marketers, understanding your market is one step to a successful marketing plan. The next is creating buyer personas to essentially put a face to the name of your target market. Use these four buyer personas to easier understand the Shampoo and Beauty market in Indonesia.

Arif

Our first buyer persona, Arif, is a single male in his early 20s. Arif lives by himself and has a monthly income of around Rp 2,000,000 - 2,999,999. For Arif, he cares about the design and looks of what he buys ('nice package design'), having many friends, and being outdoors. When purchasing shampoo, he cares most about the scent and how fashionable or trendy looking the bottle is. His favorite scent is mint and he currently uses the shampoo brand Clear. To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Arif to provide us with a picture of his bathroom. Arif's bathroom is a popular style in Indonesia. Though the style is popular and common, Arif dislikes that the bathroom is small and that there's no shower space.

Yani

Our second buyer persona, Yani, is a single male in his early 20s. Yani lives with his parents, grandparents, brothers, and sisters and has a monthly income of over Rp 10,000,000. For Yani, he cares about spending time with his family, living life to the fullest and more natural products. When purchasing shampoo he cares most about if the product is natural/organic, and its functions and benefits of use. His favorite scent is mint and he currently uses the shampoo brand Pantene. To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Yani to provide us with a picture of his bathroom.

Hayana

Our third buyer persona, Hayana, is a single female in her late 20s. Hayana lives by herself and has a monthly income of under Rp 2,000,000. For Hayana, she cares about living frugally, living life to the fullest and using more natural products. When purchasing shampoo she cares most about the reliability of the product and its scent. Her favorite scent is mint and she currently uses the shampoo brand Head & Shoulders. To get a better understanding of her lifestyle and purchasing behavioral decisions, we've asked Hayana to provide us with a picture of her bathroom. For Hayana, there is no place for her toothbrush and toothpaste so she often complains about it.

Denden

Our final buyer persona, Denden, is a married male in his early 30s. Denden lives with his parents, spouse, children, brother, and sister and has a monthly income of around Rp 5,000,000 - 5,999,999. For Denden, he cares about spending time with his family, living life to the fullest, and being outdoors. When purchasing shampoo he cares most about buying his favorite brand and buying a shampoo with a good scent. He likes more floral scents and currently uses the shampoo brand Sunsilk. To get a better understanding of his lifestyle and purchasing behavioral decisions, we've asked Denden to provide us with a picture of his bathroom above. For Denden and his family, he often complains about the size of the bathroom, it is too small.

Conclusion: A Deeper Analysis of Indonesia

Brands, end-clients such as FMCGs, and retailers will need to focus on natural ingredients, affordable prices, and packaging that saves space for this market in order to deliver on the growing consumer expectations and demand.

We hope this was an educational and interesting read for you. If you would like to run an online or mobile study in Asia, please don’t hesitate to contact us!

Download Panel Book

Download Panel Book